While the US repo crisis has been making all the headlines as of late, casual observers of the Bank of Canada’s balance sheet are often left with the mistaken impression that similar stresses exist here today in Canada. There is one particular component on the Bank of Canada’s balance sheet that often prompts accusations of increasing funding pressure and liquidity shortages in the Canadian interbank market. But just how accurate are these claims of brewing and festering issues in Canada’s repo market? Lets dig in deeper to find out.

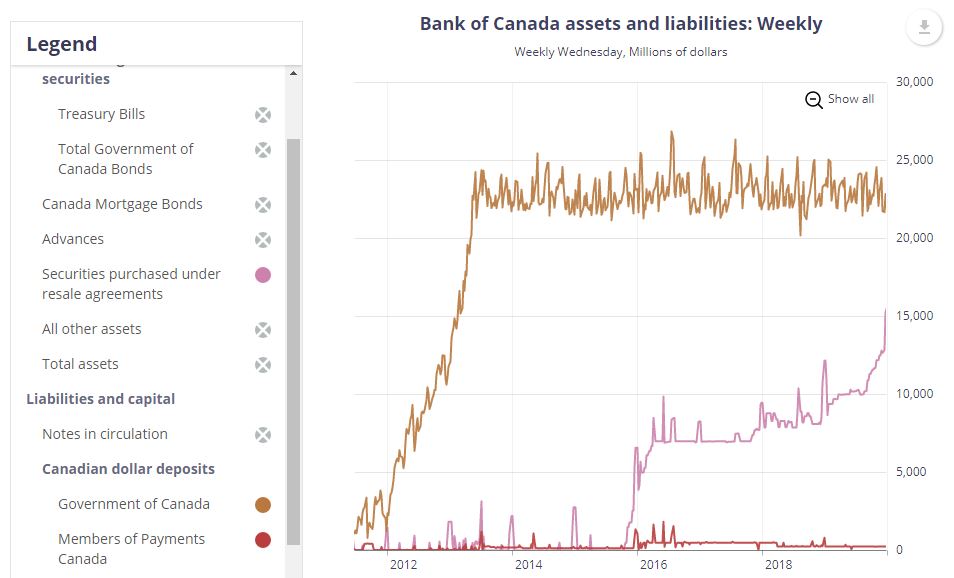

The chart below shows the “Securities purchased under resale agreements” (SPRA) component from the Bank of Canada’s balance sheet:

SPRAs are assets on the BoC’s balance sheet, which, as the chart illustrates, began to suddenly spike in 2015. After remaining relatively stable for the next several years, the BoC’s SPRA holdings once more began to accelerate higher towards the end of 2019, prompting claims that the BoC was increasingly intervening in markets in response to liquidity shortages.

To further explain, when the BoC wishes to inject short term liquidity into the market, it does so by purchasing assets from a commercial bank in exchange for bank reserves. These assets are purchased with an agreement that the commercial banks will re-purchase these same assets back from the BoC at a known price and on a set date in the near future. These “repurchase agreements” are called SPRAs on the BoC’s balance sheet, but are more commonly just referred to as “repos”.

The BoC typically engages in repo transactions in order to influence the overnight rate. When the overnight rate starts to rise above the BoC’s target, the BoC purchases assets from commercial banks (via repos) in order to increase the level of reserves in the system. The higher level of reserves increases the supply, which reduces the price (ie. the interest rate), thus relieving the upwards pressure on interest rates.

Now, it’s possible that the spike in SPRAs on the BoC’s balance sheet meant that market interest rates had been persistently higher than the BoC had intended, and the BoC was thus forced to step in and purchase assets in order to maintain its policy interest rate. In other words, it’s possible that the persistent shortage of liquidity in the interbank market caused the continuous upwards pressure on interest rates, and that the repo operations were merely the BoC’s way of adding additional liquidity. But is this really what’s happening?

If this were truly the case, then the BoC would have credited the accounts that commercial banks hold at the BoC with new reserves as payment for the purchased assets. In the following chart, these would be recorded as Canadian dollar deposits for “Members of Payments Canada”. Alternatively, commercial banks have the ability to drain their reserves by transferring Government of Canada deposits to the BoC. This would result in “Members of Payments Canada” deposits staying the same, but Canadian dollar deposits for “Government of Canada” rising by a corresponding amount in the chart below.

However, we can see that dollar deposits for both the government and commercial banks have remained relatively static during the recent spike in SPRAs on the BoC’s balance sheet. Clearly, then, the BoC has not been engaging in repo transactions with the banks in order to flood the system with reserve balances and help keep a lid on the overnight rate. On the other hand, if it turns out that the spike in repo purchases by the BoC has nothing to do with enacting monetary policy, then what exactly is causing the increase in BoC repo operations? The answer lies in the way the BoC chooses to manage its balance sheet.

As part of its regular operations, the BoC continuously issues new bank notes (paper currency) to help facilitate increasing transactions within a growing economy. These bank notes become liabilities on the BoC’s balance sheet, and the BoC must therefore balance these increasing liabilities by taking onto their balance sheet an offsetting asset. Traditionally the BoC buys government bonds to satisfy this goal, but has recently been making attempts to reduce their footprint in the government bond markets so as not to suck up the all available supply.

To achieve this goal, the BoC has started to diversify into other government-guaranteed assets which they purchase via short-term repo transactions (being a “repurchase agreement”, these asset purchases are unwound a short period later). These types of short-term assets are particularly useful for the BoC since they can better match the duration of their asset holdings with the seasonal demands for cash (ie. their liabilities).

So while repo transactions have traditionally been used to control liquidity within the banking system in order to manage the overnight rate, they have been increasingly used as of late for balance sheet management purposes. Just because the BoC has been engaging in a larger number of repo transactions doesn’t necessarily mean that there’s some sort of liquidity shortage in the overnight market. Observers will simply need to learn to be more discerning when it comes to understanding whether BoC repo transactions are enacted for the sake of monetary policy, or for the sake of managing the ever-expanding quantity of bank notes injected into the economy over time.